Making AI Chatbots Smarter with Retrieval-Augmented Generation

Looking for expert solutions in AI, Web Applications, APIs, or blockchain development?

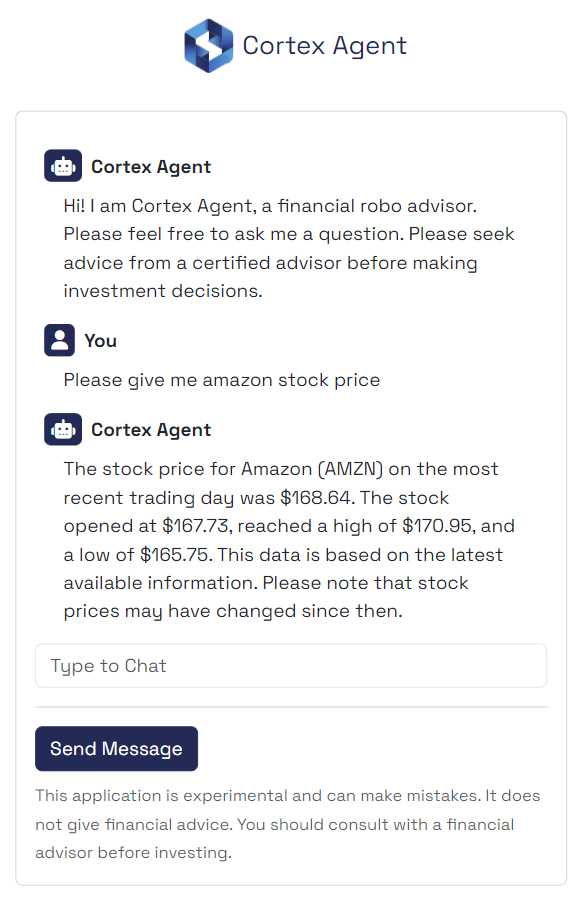

Request a Free ConsultationImagine stepping into the dynamic world of stocks and shares, where the market's pulse races with every tick of the clock. Now, picture a savvy companion at your side, one that's not just smart but downright brilliant, and ready to navigate the financial jungle with you. This isn't just any sidekick; it's a financial advisor chatbot, powered by the magic of Retrieval-Augmented Generation (RAG) and the brainpower of OpenAI's GPT-4. Welcome to the tale of how this chatbot came to be—a journey sprinkled with code, creativity, and a dash of AI magic.

At the heart of our financial advisor chatbot's intelligence lies the innovative concept of Retrieval-Augmented Generation (RAG). RAG is a powerful AI technique that amplifies the chatbot's ability to understand and respond to complex queries. Imagine it as a digital librarian that scours a vast library of information in milliseconds, fetching precisely the data needed to answer a user's question. By retrieving relevant information before generating a response, RAG enables our chatbot to not only provide answers that are rich in detail and accuracy but also tailored to the specific context of each query. This approach ensures that our chatbot is not just responding with pre-programmed answers but is dynamically crafting responses based on the latest, most relevant information available, making financial advice more insightful and personalized than ever before.

The Spark of Innovation

The inception of this project was driven by the need for a more intuitive and informed financial advisor chatbot. ChatGPT does not have current information about stock prices and other relevant financial information because its model was trained in the past. The integration of RAG with GPT-4 offered a promising solution to overcome these challenges.

Technical Foundation

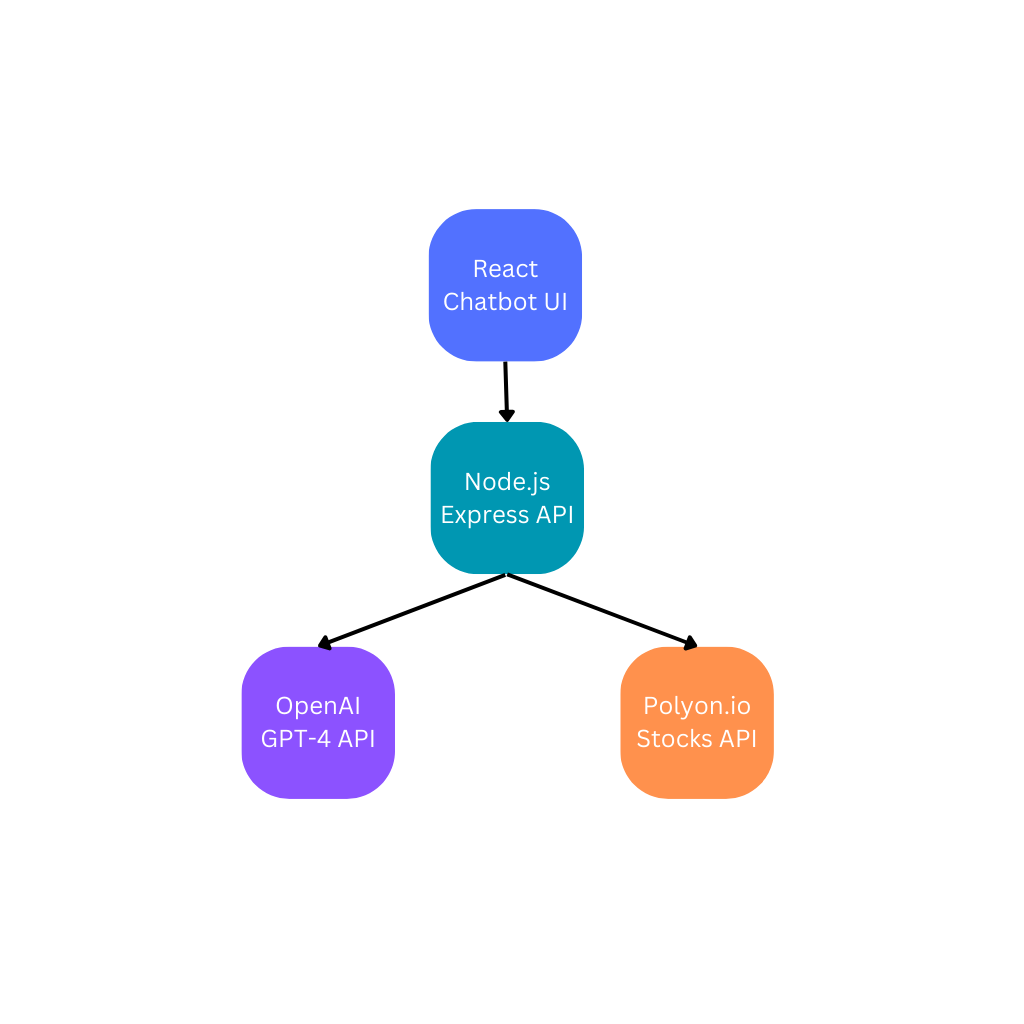

The chatbot was developed using Node.js, with an Express.js API serving as the backbone and a React-based front-end for a seamless user experience. The choice of these technologies was motivated by their flexibility, scalability, and robust community support.

Integrating RAG with GPT-4

The core of this chatbot's intelligence lies in its use of RAG, combined with the powerful language understanding capabilities of GPT-4. RAG, or Retrieval-Augmented Generation, enhances the chatbot's ability to generate responses by first retrieving relevant information from an external data source. In this case, the data source that includes stock market data accessed through a dedicated API.

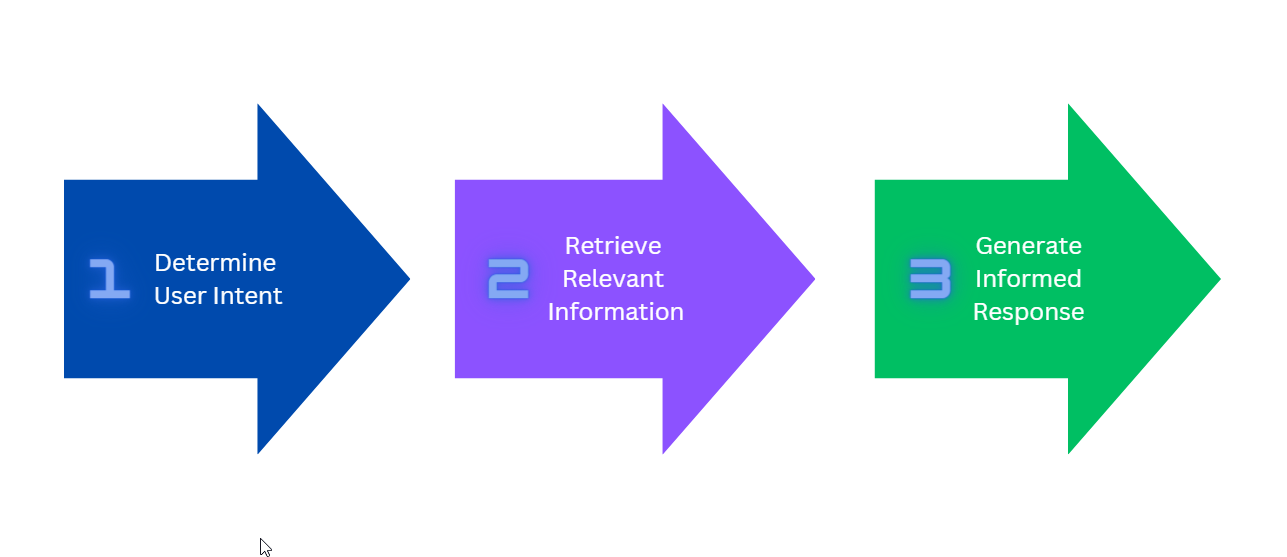

Step 1: Understanding User Intent

The first step in our chatbot's journey is akin to a detective piecing together clues to solve a mystery. Through the artful crafting of a GPT-4 prompt, the chatbot embarks on its quest to understand precisely what the user seeks—be it the latest stock price for a particular company or broader financial guidance. This custom prompt acts as a key, unlocking the user's intentions with remarkable precision. Thanks to the advanced language comprehension skills of GPT-4, the chatbot can sift through the nuances of the user's query, determining whether to embark on a hunt for specific stock information or to prepare for a dive into the vast ocean of financial advice. This crucial step ensures that every interaction with the chatbot is a step closer to fulfilling the user's financial curiosities or needs, setting the stage for a tailored and insightful conversation.

Step 2: Retrieving Relevant Data Upon identifying a query related to stocks, the chatbot then proceeds to search for relevant stock market ticker symbols within the user's prompt. This information is used to query a stock market data API, which returns real-time financial data. The chatbot code then combines the API results with the user’s prompt in order to make the GPT prompt for the next step in the process.

Step 3: Generating an Informed Response

With the user's prompt and the retrieved stock data at hand, the chatbot then passes this information in combined form through GPT-4. The AI model integrates the real-time financial data with its language model to generate a response that is not only relevant but also grounded in the latest market information.

The Result: A Smarter Financial Advisor Chatbot

The integration of RAG with GPT-4 has significantly enhanced the chatbot's ability to provide accurate and contextually relevant financial advice. Users can now receive real-time stock market insights and answers to complex financial queries in a conversational manner. This advancement represents a leap forward in the development of AI-driven financial advisory services, offering users a more informed and intuitive experience.

Conclusion

The journey of developing this financial advisor chatbot has been both challenging and rewarding. By leveraging the synergies between RAG and GPT-4, we have been able to create a chatbot that stands out for its accuracy, responsiveness, and depth of understanding. This project underscores the potential of advanced AI models in transforming financial technologies and the way we interact with digital financial advisors.

As we continue to explore and integrate further advancements in AI, the future of financial chatbots looks promising, offering endless possibilities for enhancing user experience and making financial advice more accessible to everyone.

Retrieval Augmented Generation with Node.js: A Practical Guide to Building LLM Based Applications

"Unlock the power of AI-driven applications with RAG techniques in Node.js, from foundational concepts to advanced implementations of Large Language Models."

Get the Kindle Edition

Designing Solutions Architecture for Enterprise Integration: A Comprehensive Guide

"This comprehensive guide dives into enterprise integration complexities, offering actionable insights for scalable, robust solutions. Align strategies with business goals and future-proof your digital infrastructure."

Get the Kindle EditionWe create solutions using APIs and AI to advance financial security in the world. If you need help in your organization, contact us!

Cutting-Edge Software Solutions for a Smarter Tomorrow

Grizzly Peak Software specializes in building AI-driven applications, custom APIs, and advanced chatbot automations. We also provide expert solutions in web3, cryptocurrency, and blockchain development. With years of experience, we deliver impactful innovations for the finance and banking industry.

- AI-Powered Applications

- Chatbot Automation

- Web3 Integrations

- Smart Contract Development

- API Development and Architecture

Ready to bring cutting-edge technology to your business? Let us help you lead the way.

Request a Consultation Now